Introduction

Did you know that over 72% of financial institutions globally are investing in AI to improve their services? This investment reflects the rapid evolution of fintech, where AI in financial services is becoming indispensable. As such, generative AI in fintech is emerging as a breakthrough by creating new ways to personalize financial products.

Generative AI, which can provide personalized product recommendations, is giving fintech firms a crucial competitive edge. In today’s cut-throat market, personalized fintech services aren’t just nice to have—they’re a must. Hence, financial institutions increasingly rely on AI-driven solutions to build deeper customer relationships. As the technology evolves, gen AI promises to transform fintech, offering unprecedented personalization that will redefine the future of fintech and how we interact with financial services.

The Rise of Generative AI in Fintech

Picture this: a financial model that not only analyzes your investment habits but also crafts tailored financial strategies based on your personal needs and goals. Generative AI differs from traditional AI because it doesn’t just analyze data—it creates new, personalized insights and strategies. It’s like having a financial assistant who knows your preferences and shapes products to fit perfectly.

A Quick Look at the History

AI has been in the fintech industry for years, primarily detecting fraud and managing customer support. Generative AI, however, introduces a new era of fintech personalization. It enables financial institutions to develop bespoke solutions for each customer, bringing unprecedented value.

Current Applications of Generative AI

- Personalized Banking and Investment: Imagine a tool that predicts your next best financial move. For example: JPMorgan Chase’s IndexGPT uses Generative AI to analyze investment opportunities and give personalized advice.

- Fraud Detection and Compliance: Bank of America’s AI system reviews billions of transactions daily to detect any unusual activity, protecting customers while meeting compliance standards.

- Enhanced Customer Engagement: Fintech companies like Tyme Group and Ally Bank employ Generative AI chatbots to offer investment advice and increase customer engagement. These AI systems adapt to individual preferences, keeping the conversation relevant and personalized.

- Predictive Analytics: Banks use Generative AI to develop smarter strategies by understanding market trends and minimizing risks. They predict trends more accurately, helping customers get ahead of the curve.

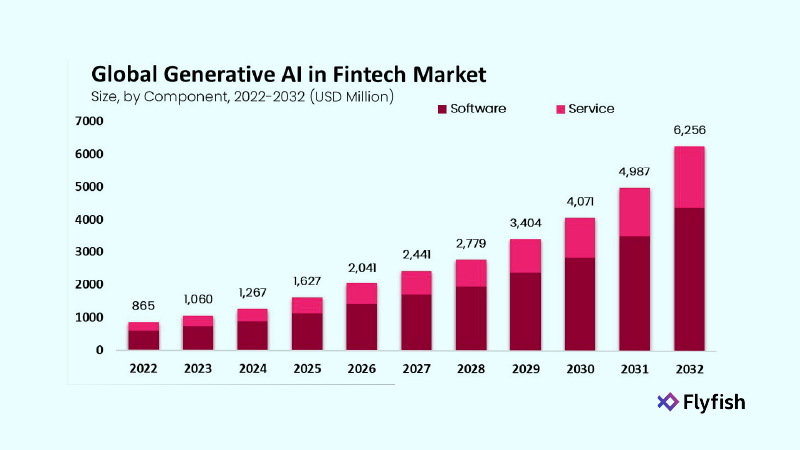

Generative AI Financial Products are making waves in fintech, helping institutions stay competitive by personalizing services and providing deeper insights. According to a study, the market is set to reach nearly $10 billion by 2030.

With such transformative potential, Generative AI in fintech promises to shape the future of financial services in a way that’s both exciting and empowering.

Personalization of Financial Products with Generative AI

Generative AI is ushering in a new era of fintech personalization, offering solutions that feel uniquely tailored to each individual. By recognizing patterns in customer data, these models generate financial products that suit personal goals, risk tolerance, and preferences.

Let’s look into how this hyper-personalization plays out.

How Generative AI Enables Personalization?

Generative AI relies on a comprehensive understanding of customer behavior and preferences. It analyzes transaction histories, investment goals, and even external factors like market trends to create bespoke solutions. For instance, a customer looking for stable returns and minimal risk will receive a portfolio different from someone chasing aggressive growth.

Examples of Personalization in Action:

- Customized Investment Portfolios:

Fintech companies are using AI to tailor investment strategies to individual needs. Robo-advisors can adjust allocations based on lifestyle changes or market shifts, offering customers peace of mind that their investments are always aligned with their goals. Wealth management firms are increasingly using Generative AI to offer such services efficiently. - Personalized Insurance Packages:

Insurance providers are now designing policies based on data insights gathered through Generative AI. By examining customer profiles and preferences, they can adjust coverage options, pricing, and benefits to better match the customer’s unique needs, ensuring that each policyholder gets maximum value. - Credit Assessments and Lending:

Traditional credit scoring methods often miss nuances, leaving many worthy borrowers underserved. Generative AI digs deeper, analyzing transaction patterns, spending behavior, and even social data to offer a more nuanced assessment. This results in fairer lending practices and empowers customers who previously found it challenging to access loans.

Benefits of Personalization for Institutions and Customers

For financial institutions, hyper-personalization means increased customer loyalty and engagement. By providing services that resonate with individual goals, companies can foster deeper relationships and reduce churn. Customers, in turn, benefit from financial advice and products that genuinely help them reach their objectives. They can trust that their financial partners understand their unique situations and are equipped to support them at every turn.

Generative AI in fintech personalization is creating a win-win scenario, where institutions improve their bottom line while customers enjoy a more customized and satisfying financial experience.

The Technology Behind Generative AI in Fintech

Generative AI in the fintech industry relies on several core technologies to deliver the sophisticated personalization it’s known for, specifically machine learning, neural networks, and data analytics.

Here’s a closer look at how these components work together:

Machine Learning and Neural Networks

Generative AI in fintech leverages machine learning models, particularly neural networks, as its core technology. These neural networks emulate the human brain’s information processing, comprising interconnected layers specialized in recognizing various patterns. Deep learning models such as GPT (Generative Pre-trained Transformer) utilize extensive neural networks to analyze large datasets, uncover complex relationships, and produce highly relevant outputs.

Data Analytics and Processing

To create personalized financial solutions, Generative AI requires access to high-quality, diverse datasets. Financial institutions must gather comprehensive customer data, including spending patterns, investment preferences, and historical transactions. Advanced data analytics helps clean, organize, and preprocess this data for AI models to learn effectively, enabling better predictions and personalization.

Computational Needs and Infrastructure

Training these models requires substantial computational resources. For fintech firms, this means investing in high-performance computing infrastructure, like GPUs or TPUs, that can handle large-scale parallel processing. Cloud computing platforms provide scalable storage and computational power, making it easier for financial institutions to implement Generative AI solutions. Moreover, fintech companies must ensure secure data handling, encryption, and regulatory compliance.

Generative AI in Fintech – A New Era of Personalization

As Generative AI continues to redefine fintech personalization, financial institutions must prioritize innovation while ensuring data security, regulatory compliance, and ethical use. This technology, which enables hyper-personalized financial products, will undoubtedly shape the future of fintech by fostering deeper customer engagement, reducing fraud risks, and creating financial services that align with individual goals. Thus, embracing AI generative platforms that offer exceptional personalization in fintech is essential to stay ahead in this new era.

Flyfish: Transforming Financial Services with Generative AI

Flyfish provides innovative AI solutions to financial institutions, analyzing clients’ financial behaviors, transaction histories, and preferences. This helps tailor financial services and products to each customer’s specific needs, improving financial outcomes and fostering long-term client relationships. Flyfish runs on a SaaS model with flexible deployment on platforms like Azure, GCP, and AWS. As such, the pay-as-you-go pricing and pre-built connectors enable quick and efficient implementation.

Let’s take a look at some of the key features of Flyfish:

- AI-Powered Search: Utilizes advanced AI to enhance search capabilities, ensuring relevant and timely information.

- Personalized Recommendations: Offers the best financial product suggestions tailored to individual client goals and preferences.

- Conversational Commerce: Enables seamless interactions through AI-driven conversations, enhancing customer engagement.

- Seamless Integration: Easily integrates with existing financial technology, handling both structured and unstructured data.

- Comprehensive Capabilities: The AI Financial Advisors provide personalized investment advice, portfolio management, risk assessment, and compliance checks, allowing human advisors to focus on complex tasks.

- Omnichannel Engagement: Supports consistent communication across digital platforms, ensuring a seamless client experience.

So, how has Flyfish made a difference?

Flyfish has successfully onboarded major banks and financial institutions in India and Singapore, receiving positive feedback for improving conversion rates by 3 to 5 times and reducing customer acquisition costs. The best part? Its solutions help financial institutions better understand and meet individual client needs, leading to enhanced client satisfaction and sustainable business growth.

Bottom Line

In conclusion, given its capacity to improve consumer interactions, decision-making, and process optimization, generative AI offers a potential path for fintech innovation. For those seeking to capitalize on these transformative capabilities within the financial sector, FlyFish emerges as the premier choice. Its comprehensive platform is tailored to drive meaningful results and propel fintech into a new era of advancement. Flyfish stands out as the best option for individuals wishing to use generative AI in fintech.

Transform your fintech journey with Flyfish’s groundbreaking generative AI – join us and lead the way forward!